Active Ownership

By leveraging our active ownership capabilities, we aim to seize the best investment opportunities to build more resilient portfolios with better risk-adjusted returns on long-term investments for our clients.

Our approach

Our main objective is to promote sustainability practices and good governance within our investee companies. This is done by way of active engagement and participation at general meetings and through cultivating a trusted relationship with the companies we invest in.

Generali Asset management acts on two levels:

VOTING ACTIVITY

ENGAGEMENT WITH COMPANIES

Livio Gentilucci

Head of Active Ownership

2024 overview

Voting activity

SHAREHOLDERS MEETINGS

RESOLUTIONS VOTED

COUNTRIES COVERED

NEGATIVE OPINIONS

François Humbert

Lead Engagement Manager

Engagement with companies

ENGAGEMENTS

SUCCESSFUL ENGAGEMENTS

ENGAGEMENTS WITH ADDITIONALITY

Governance 24%

Environment 49%

Social 27%

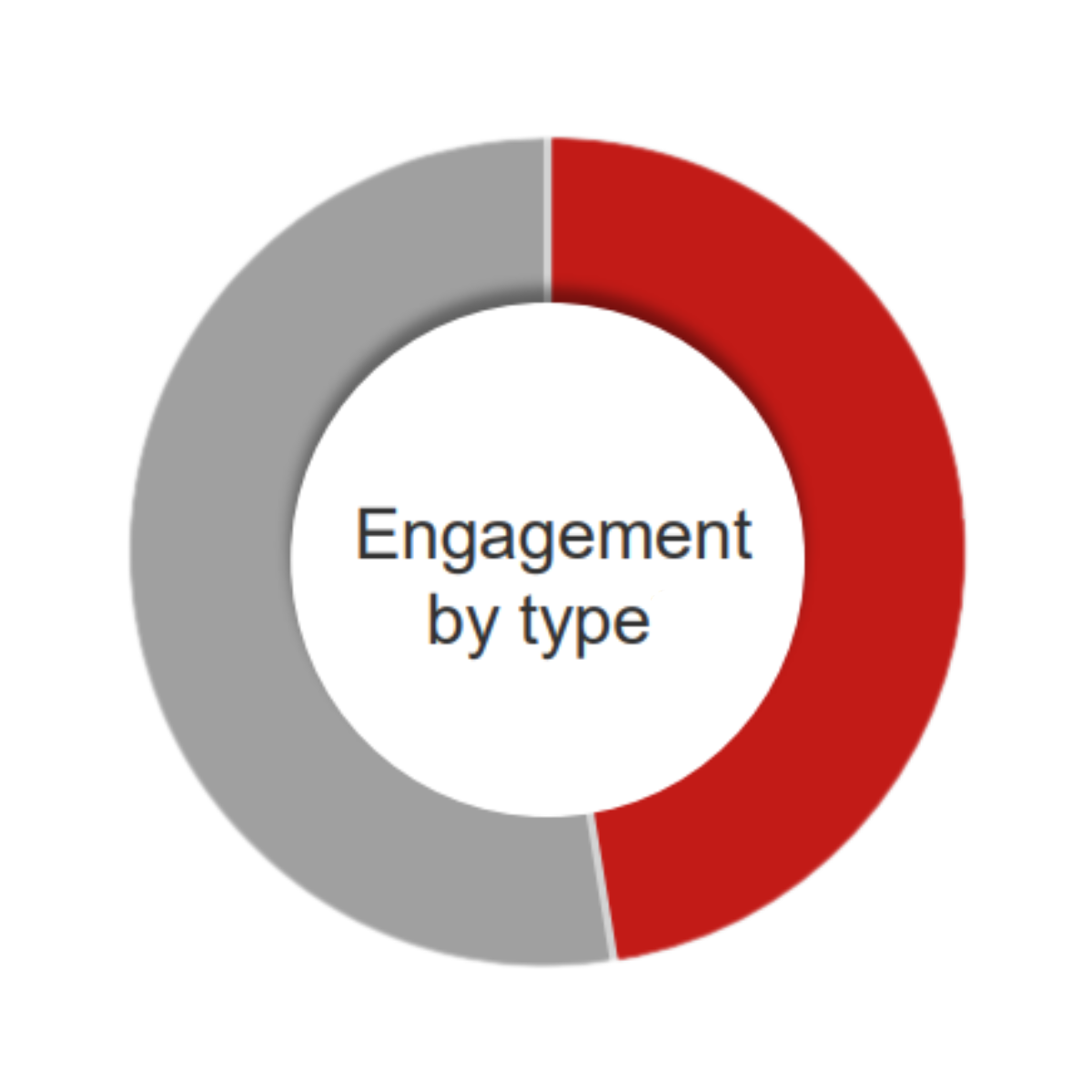

Direct 53%

Collaborative 47%

Enel: a successful case study

In June 2023, a group of investors, members of the Italian Sustainable Investment Forum (ItaSIF – Forum per la Finanza Sostenibile*) and a select group of Climate Action 100+** investor signatories, developed three expectations for Enel.

Disclose the coal phase out strategy (high level principles);

Disclose a road map that defines milestones plant by plant;

Disclose the context and constraints applying to coal plants in Italy and Spain.

As a result of the engagement with this group of investors led by Generali AM and Kairos Partners, Enel has published a dedicated coal section in its 2023 Sustainability Report, including:

The reiteration to phase out coal by 2027;

The previous trajectory of coal capacity since 2015;

A detailed roadmap for each of the remaining coal plants;

A detailed process which ENEL follows to close a plant.

All parties acknowledged the progress Enel has made in disclosing its Net Zero strategy in general, including a deep dive into its plan to phase out coal generation.

*The Italian Sustainable Investment Forum (ItaSIF) is a multi-stakeholder, non-profit association founded in 2001. Members are not only financial operators, but also civil society organizations involved in the environmental and social impact of finance. ItaSIF has more than 170 members among asset managers, banks, insurance companies, pension funds, NGOs, and other organizations.

**Climate Action 100+ is an investor-led initiative, which aims to ensure the world’s largest corporate greenhouse gas emitters take action on climate change.

Reports*

* Kindly note that on 1 January 2024, Generali Investments Partners S.p.A. Società di gestione del risparmio ("GIP") has been merged by incorporation into Generali Insurance Asset Management S.p.A. Società di gestione del risparmio ("GIAM"), changing its name to Generali Asset Management S.p.A. Società di gestione del risparmio ("GenAM"). The above disclosed documents thus refer to the sum of the two entities at the reference date, until such time as the new documents of Generali Insurance Asset Menagement S.p.A. Società di gestione del riparmio renamed as Generali Asset Management S.p.A. Società di gestione del risparmio will be provided.